Auto insurance companies are enticing drivers with policy discounts if drivers agree to attach a tracking device to their vehicles. The so-called “telematic devices” provide insurance companies insight into a driver’s behaviors, such as miles driven, speed, and frequency of driving. Insurance companies’ data-tracking programs, such as Progressive Snapshot, provides drivers with opportunities to save if they adopt good habits.

Similarly, Esurance launched the RepairView program which allows drivers to see photos of their vehicles as they are being fixed at the repair shop.

In the commercial B2B world, Kespry, an aerial-drone inspection company, provides a model for how to transform insurance inspections for roofs. The aerial inspection system allows insurance carriers to use on-site and mobile-based drone tools to process claims faster, deliver more accurate risk assessments, and inspect assets in an hour with transparency.

As the insurance industry evolves, we can imagine many of these improvements could apply to underwater asset insurance carriers. There are many opportunities for ship and aquaculture farms to similarly benefit from technology advances to streamline their insurance and regulatory compliance.

Insurance and Regulations on Underwater Assets

Ships and aquaculture farms need insurance protection in the same way that tradition consumer assets, such as a car or house, benefit from insurance. The difference for vessels and aquaculture farms is the challenge of inspecting the assets for appraisal and the claims process due to the difficulty of inspecting these underwater assets.

Because it is too expensive to put a ship on dry dock and near impossible to bring an offshore aquaculture farm to land, insurance companies rely on diving inspection companies to perform inspections in the present day.

In the context of aquaculture, insurance may compensate a fish farm for a fish escape because it’s considered a loss of assets, like farmers can file claims for adverse weather that destroys their crops and harvest.

Additionally, regulatory agencies may fine fish farms for fish escapes, which are considered environmental pollution because they endanger existing ecosystems.

How Underwater Inspections Are Performed Today

As part of the insurance appraisal and monitoring process, as well as for regulatory compliance, fish farms contract with inspection companies to view the condition of their fish farms. Typically, three or four divers from the hired inspection company inspect a subset of the fishnets at the aquaculture farms for net tears and other structural weaknesses that may cause fish to escape.

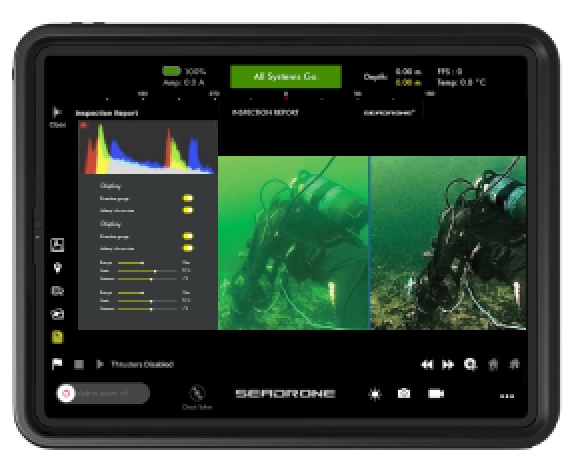

Divers fill out paper checklists after completing their dive. The information is later transcribed into official paperwork for insurance companies and regulatory agencies. This process is unreliable due to the likelihood of human errors when transcribing as well as inaccuracies that occur due to relying on human memory.

How ROVs Can Streamline Inspections

One inspection from a diving company can cost $USD3,500-4,000 per day at a fish farm in a country such as Norway. Considering the cost of human divers from the perspective of time, money, and safety, it makes sense to consider where there is a benefit for ROVs to perform these inspections instead.

The world of subsea inspections can follow the Kespry aerial inspection industry’s lead by using micro ROVs to inspect underwater assets.

Why ROV Inspections Could be a Win-Win-Win-Win

In the example of aquaculture, the inspection company, the fish farms, the insurance companies, and the regulatory agency can all benefit from adopting ROVs to perform fish farm inspections.

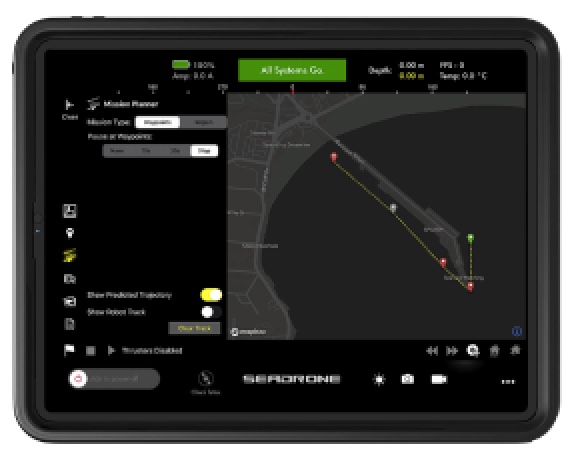

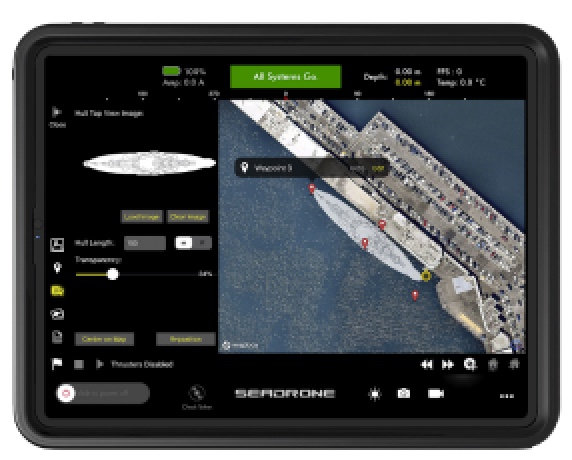

The cost of human divers is high for the inspection companies due to safety regulations as well as the time it takes for human divers to perform the inspection. Performing an ROV inspection, such as using the SeaDrone Inspector 3 vehicle, can take an hour or less for the entire inspection. This translates to cost savings and improved accuracy in inspection reports that greatly benefit clients.

Fish farms often encounter problems with purchasing Fish Stock insurance because insurance companies do not trust their current documentation methods. Having robust photo and video inspection footage of the fish farm’s infrastructure would allow farms to better document their environment, possibly leading to cost-effective policies and discounts similar to the car tracking devices.

Insurance companies benefit from photo and video documentation of fish farms and more frequent inspections. When inspections don’t endanger human lives, are cheaper, and can be performed more frequently due to using an ROV, it becomes easier for insurance companies to trust ROV subsea inspections. Frequent monitoring of fishnets and structural integrity could lower the risk for insurance companies.

Furthermore, the photo and video footage from the ROV can be encrypted. This benefit allows the fish farm’s ROV pilot to collect data and send the encrypted data to the insurance company. An auditor can review the footage at the insurance company’s headquarters, rather than coming onsite to the fish farm. It also reduces the inefficiencies of an inspection crew relaying the inspection report back to the insurance carrier if the fish farm can provide the data directly to the auditor.

Finally, the regulatory agencies can audit the maintenance operations and conditions at the fish farms more easily with the transparency that ROV inspections offer. Frequent and low-cost inspections using an ROV give regulatory agencies access to fish farm conditions that can help detect potential fish escapes before they happen.

In addition to these benefits, there are many opportunities to build intelligence on the data that is collected from ROV inspections, which would be difficult to achieve using human inspections. Over time, there is a huge potential for predictive data analytics in this area. Imagine using the inspection data collected from ROVs to make predictions on what kinds of conditions lead to structural failures and what conditions produce higher yields.

There is huge potential awaiting insurance companies, regulatory agencies, inspection companies, and businesses owning underwater assets to consider ROVs for inspections. It is an exciting time to see whether inspiration from auto insurance companies will translate to more sophisticated data tracking programs in underwater inspections. The advances in technology promise to deliver wins for all parties involved.